Global demand for silver ore to overtake gold in 2021 (Experts)

Global demand for silver ore will reach 1.025 billion ounces in 2021, its highest level in eight years, as investors and industry step up purchases, the Silver Institute said on Wednesday, forecasting a rise in prices.

The coronavirus outbreak has sparked a rush among investors to store cash, which, like gold, is traditionally considered a safe place to store cash.

Experts say that momentum will continue, the institute said, predicting purchases of bullion and coins to reach a six-year high of 257 million ounces in 2021.

He didn’t give a forecast for exchange-traded funds (ETFs) stocking silver bars for large investors, but these have seen strong growth so far this year, helping push prices down. an eight-year high of $ 30.03 an ounce on Feb.1 silver is also used in industries such as electronics and solar panels, and demand will increase as the pandemic is brought under control and the The global economy will rebound, the institute said.

Industrial demand will increase 9% from 2020 to peak at 510 million ounces in four years, he said.

Silver demand for jewelry will rise to 174 million ounces but will remain below levels seen before the pandemic.

On the supply side, mining production is expected to reach 866 million ounces this year, the maximum since 2016, as disruption from the pandemic recedes and recycled supply increases for a fifth year, said the ‘institute.

The market will be slightly oversupplied, its sixth consecutive annual surplus, the institute said. It calculates its supply-demand balance without counting ETFs.

“The outlook for the price of silver in 2021 remains exceptionally encouraging, with the annual average price expected to increase 46% to … $ 30,” he said in a statement.

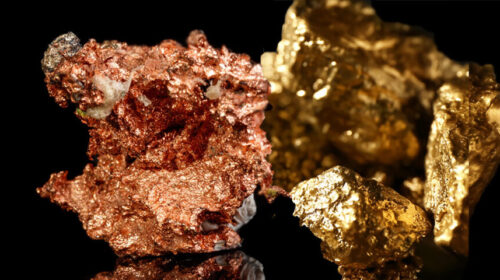

“Considering the tighter silver market and the increased price volatility this can generate, we expect silver to comfortably outperform gold this year.

The Silver Institute prepares its reports with the help of Metals Focus, a precious metals consultancy.

![]()